Interview with two of the authors of the ‘National Living Income’ study

The General Workers’ Union, Allianza Kontra l’Faqar and the Graffitti Movement teamed up with Rethink Advisory about a year ago to publish a detailed scientific study on how much money a Maltese ‘household’ needs to live a decent life/standard of living.

A few months after the publication of this study, we met with Jake Azzopardi and Dr. Daniel Gravino, two of the authors of the study, to talk in more detail about the purpose of the study and its findings.

They explained that they began their work by trying to find a clear definition of what we mean when we talk about a reasonable/decent standard of living and a way to measure that reasonable income. They wanted to establish an amount up to which a ‘household” is not affected by poverty/deprivation and which covers the essential costs for the family to meet the needs that are truly essential for survival. Provided that the amount covers the costs that allow the family to live a comfortable, meaningful life that allows them to fully participate in society, where they can recreate and have access to services/clothing that improve their quality of life. All of this is reflected in the methodology they used to arrive at the numbers they published.

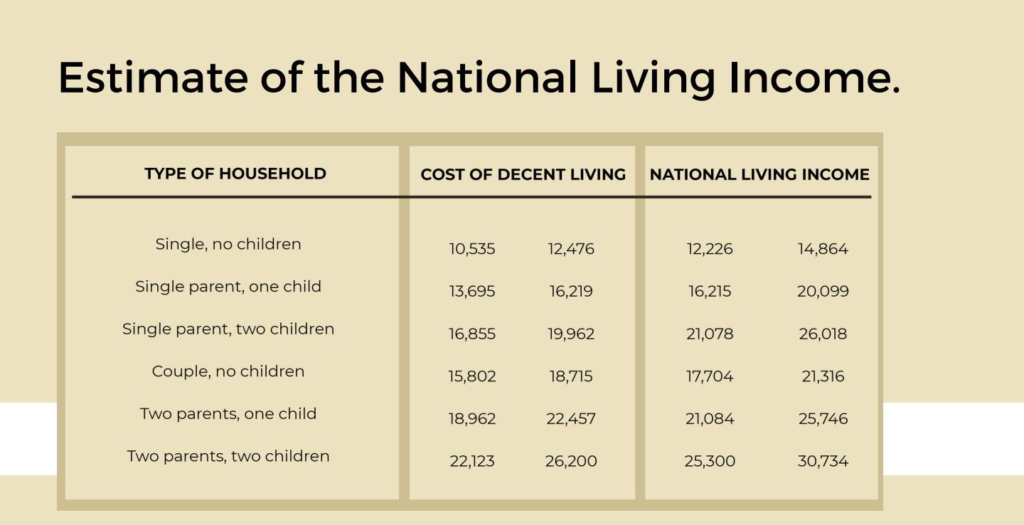

The culmination of the study was to finally publish figures on what the ‘National Living Income’ should be, and a total of six figures were published, as a distinction was made between the money that ‘households’ would need, composed of a different number of people, by analyzing the most common types. That is, a ‘household” composed of one person, a ‘household’ with one person and one child, a ‘household’ with one person and two children, a ‘household’ with two adults and two children, a couple with one child, and a “household’ with retirees. In this study, the income of individuals was quantified in order to achieve their goals, that is, to live a good, comfortable and adequate life.

One of the objectives of the study was, after determining the income of certain “household types,” to compare the income of these individuals with the income required for a good life. Thus, they determined what the ‘National Living Income’ should be, and they determined the percentage of how many ‘households’ have incomes that are below that level. They indicated the amount of income that would be sufficient for a household to cover 40% to 50% of the expenses of an average family.

This study shows the national lifetime income for the six types of households studied: For example, the NLI for a single adult without children is €14,864 (all results in print). It can be seen that among the different types of families, single-parent families (30%) and retired families (70%) are the most common, where the family does not reach the income considered adequate according to the study.

The authors of the study arrived at these figures by examining the 1,000 most popular family types in Malta and the most popular types of income. They looked at what kind of spending they do by examining a basket of needs and expenses they make and how they manage their finances according to those needs, and they saw where they seem to be suffering. A method was used that included interviews and focus groups, as well as a scientific survey that collected a thousand responses.

By the term “basket of goods” is meant not only the cost of daily living, but also the additional expenses that everyone has, even for leisure activities that most families in Malta spend – such as the use of a private doctor, payments for the car – fuel, mechanic, payments for insurance, tutoring, buying books, replacing equipment, going out to eat or deliveries. These are additional expenses for which one should have income without falling into a crisis.

It’s hard to say why these two categories can not keep up. But if you look at a single mother who has to take care of the kids alone, you understand that she has less time to go to work. Retirees, on the other hand, have no income other than their pension.

Now we know how many people there are whose income needs to be supplemented, and by how much it needs to be supplemented. An important goal he wanted to achieve with this study is to provide meaningful information that can be put on the table and discussed so that more proactive social policies can be built on it.

A tool that will lead to insightful discussions with social partners and the government about assistance so that there is no more income inequality and instead certain groups of households move up. A tool that will potentially help use public resources more efficiently and raise the level of our economy so that these people start earning a decent income that helps people in general.

In fact, just recently in the budget, which was set at a time of very high global inflation, which was almost unprecedented, the government, together with the social partners, looked at how high the COLA should be, and people received the earned increase for the level of living, as well as an additional COLA for those who, as mentioned here, do not receive a certain income, the so-called ‘vulnerable.”

The ideal is, above all, that everyone who works is far from poverty. A condition that benefits society in general, in which families have an income that allows them to live a decent life. Because apart from suffering themselves, society in general suffers. On the other hand, it is good for everyone if everyone earns a decent income. Everyone has something to gain.